BitMart’s Compliance with AML and KYC Regulations: Ensuring a Secure Environment

BitMart’s Compliance with AML and KYC Regulations: Ensuring a Secure Environment

Introduction

In today’s digital world, where cryptocurrency is gaining popularity, ensuring a secure environment for users is of utmost importance. BitMart, a leading cryptocurrency exchange platform, understands the significance of maintaining compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Let’s delve into how BitMart ensures a secure environment for its users while complying with these essential regulations.

Why AML and KYC Compliance is Necessary

1. What is AML Compliance?

Anti-Money Laundering (AML) compliance refers to a series of laws, regulations, and procedures implemented by financial institutions to prevent illegal activities such as money laundering and terrorism financing. AML compliance measures are put in place to identify and mitigate any risks associated with money laundering within the financial system.

2. What is KYC Compliance?

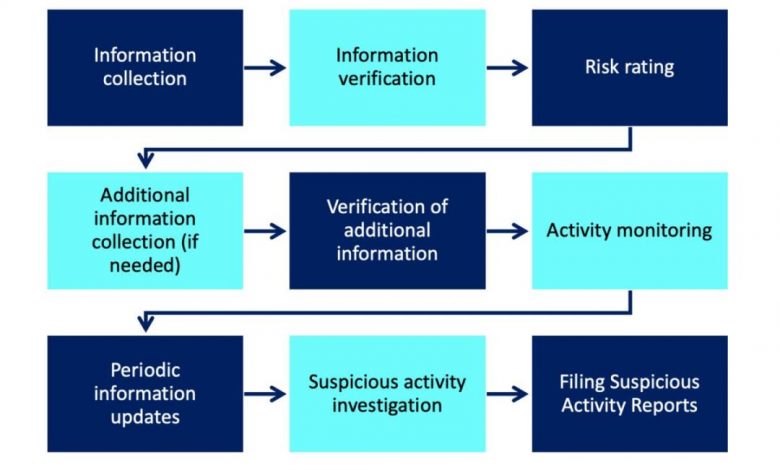

Know Your Customer (KYC) compliance is a vital component of AML regulations. KYC requirements necessitate businesses to verify and authenticate the identity of their customers before engaging in any financial transactions. This verification process helps prevent financial crimes, fraud, and identity theft.

BitMart’s AML and KYC Practices

1. Stringent Customer Verification Process

When users sign up on BitMart, they are required to go through a thorough verification process. This process includes the submission of personal identification documents such as passports or driver’s licenses, along with proof of address. By accurately verifying the identity of their users, BitMart ensures a safe and secure trading environment.

2. Continuous Transaction Monitoring

BitMart employs advanced technology to monitor transactions in real-time. Their sophisticated algorithms identify any suspicious or potentially illegal activities and enable immediate action to be taken. This constant monitoring helps prevent money laundering and ensures compliance with AML regulations.

3. Collaboration with Regulatory Authorities

BitMart maintains a strong collaboration with regulatory authorities, ensuring that they stay up to date with the latest AML and KYC requirements. By actively engaging with these authorities, BitMart ensures that their compliance measures are comprehensive and effective in preventing any potential risks or threats.

FAQs about BitMart’s Compliance with AML and KYC Regulations

1. Can I use BitMart without completing the KYC process?

No, BitMart requires all users to complete the KYC process before they can engage in any trading activities on their platform. This is done to ensure the security and compliance of all transactions.

2. How long does the verification process take on BitMart?

The verification process on BitMart usually takes a few hours, but it can vary depending on the volume of verification requests. BitMart strives to process verifications as quickly as possible to enable users to start trading without any delays.

3. What happens if fraudulent activity is detected on BitMart?

If fraudulent activity is detected on BitMart, the platform takes immediate action to prevent any further damage. This may include freezing affected accounts, reporting the incident to regulatory authorities, and cooperating fully with investigations.

Conclusion

BitMart’s compliance with AML and KYC regulations plays a crucial role in ensuring a secure trading environment for users. Through stringent customer verification, continuous transaction monitoring, and collaboration with regulatory authorities, BitMart demonstrates its commitment to combating financial crimes and safeguarding its platform. By prioritizing compliance, BitMart provides users with peace of mind and a reliable platform to engage in cryptocurrency trading.